HG Infra Engineering recently announced something that can be termed a tough quarter. The company’s stock declined by an 8 per cent margin as the earnings and sales of the firm were disappointed. The trend also hinted towards the development of further declines in the infrastructure company’s performance. Specifically, the Q2 earnings report sent alarm bells ringing over the revenue and net profit performance of the company, which precipitated large sell-offs affecting the stock of the company. In this update, we now break down the key factors in HG Infra’s performance, the key factors that could affect its performance, and what it might mean to the company and its investors.

Zooming in on HG Infra’s Q2 Financial Results

On November 12, HG Infra Engineering reported a set of not-so-great quarterly results, with year-over-year declines both in net profit and revenue.

-

Net Profit:

While net profit slipped 16% to Rs 80.7 crore against Rs 96.1 crore recorded last year in the corresponding period, the significant decline in profitability has been the major market driver on the downside.

-

Revenue from Operations:

Revenue declined 5.5% at Rs 902.4 crore for the quarter compared with Rs 954.5 crore a year earlier. This decline in revenue indicates a slowing pace of the company’s operations as well as its revenue generation, which has affected its bottom line overall.

-

EBITDA and Margin:

On a normal operating level, HG Infra logged EBITDA of Rs 219.5 crore, which is merely a tiny decline from Rs 220.1 crore it posted in Q2 last fiscal. However, managing such a small decline still could prove slightly better margins at 24.3%, hinting at slightly better operational efficiency even in declining revenues.

Even though the company had undertaken efforts that were aimed towards increasing business efficiency, which was reflected in the growing EBITDA margin, those efforts could not counterbalance the net decline along with revenue.

-

Share Market Reaction:

Following the Q2 result, HG Infra’s share price plunged 8% in morning trade on November 12 to Rs 1,180 on the National Stock Exchange. It was trading at Rs 1,195 at 10:20 am, or 7% lower than the previous close. Over the past three months, HG Infra’s stock has declined by 26%, which is not only a knee-jerk reaction but, also part of an all-round downtrend and a reflection of declining investor confidence in the company’s short-term prospects.

Underlying Reasons for Weak Performance by HG Infra

Internal and external factors have contributed to the underwhelming Q2 results. Here’s a look at some of the reasons behind the company’s decline:

1. Macro challenges for the infrastructure industry

The infrastructure industry has been battered with macro challenges like increasing input prices, fluctuating demand, and regulatory uncertainty. All such aspects have made it challenging to maintain revenue growth players like HG Infra.

2. Project Execution Delays and Funding Constraints

This business of HG Infra is largely project-based, as it is an infrastructure company where revenue depends on project execution and completion. Hence, potential construction-related delays can be linked to issues such as logistics, labour scarcity, or funding constraints, which lead to a reduction in revenue.

3. Growth in Competition and Cost Pressure

The highly competitive nature of the infrastructure industry, upon which they must operate, has led to dragging profit margins down; there is aggressive bidding by companies to secure some contracts. HG Infra won a major road project in Gujarat, but this was procured at a bid substantially below the estimate of the Ministry of Road Transport and Highways. The bid of Rs 781.11 crore for a 10.63 km stretch along NH 47 was astonishingly less than the estimated cost of Rs 883.24 crore which will most probably affect the future profitability of this project.

4. Interest and Depreciation Expenses

Infrastructure is a capital-intensive business, with high costs that inflate interest and depreciation expenses. These, without sufficient offset by profitability, just eat further into profitability if revenue growth lags the firm’s financial obligations.

Major Recent Events in HG Infra

-

Award of a Major Contract in Gujarat

It emerged as the lowest bidder for an upgrade job on a 10.63 km stretch of National Highway 47 in Gujarat at Rs 781.11 crore. The project will be under the hybrid annuity model and is likely to be completed in around 2.5 years. The order shows how HG Infra has an edge over competitors with large orders but may also have an impact on profitability due to the reduced size of the order.

-

Hybrid Annuity Model Project

The hybrid annuity model under which HG Infra will share the financial risk and reward with the government is one way of lessening the pressure on the finances of the company. Though this strategy reduces the pressure on the finances of the company, it stretches the revenue from the project over time, therefore short-term cash flows may be delayed.

-

Expansion Focus on Core Competencies

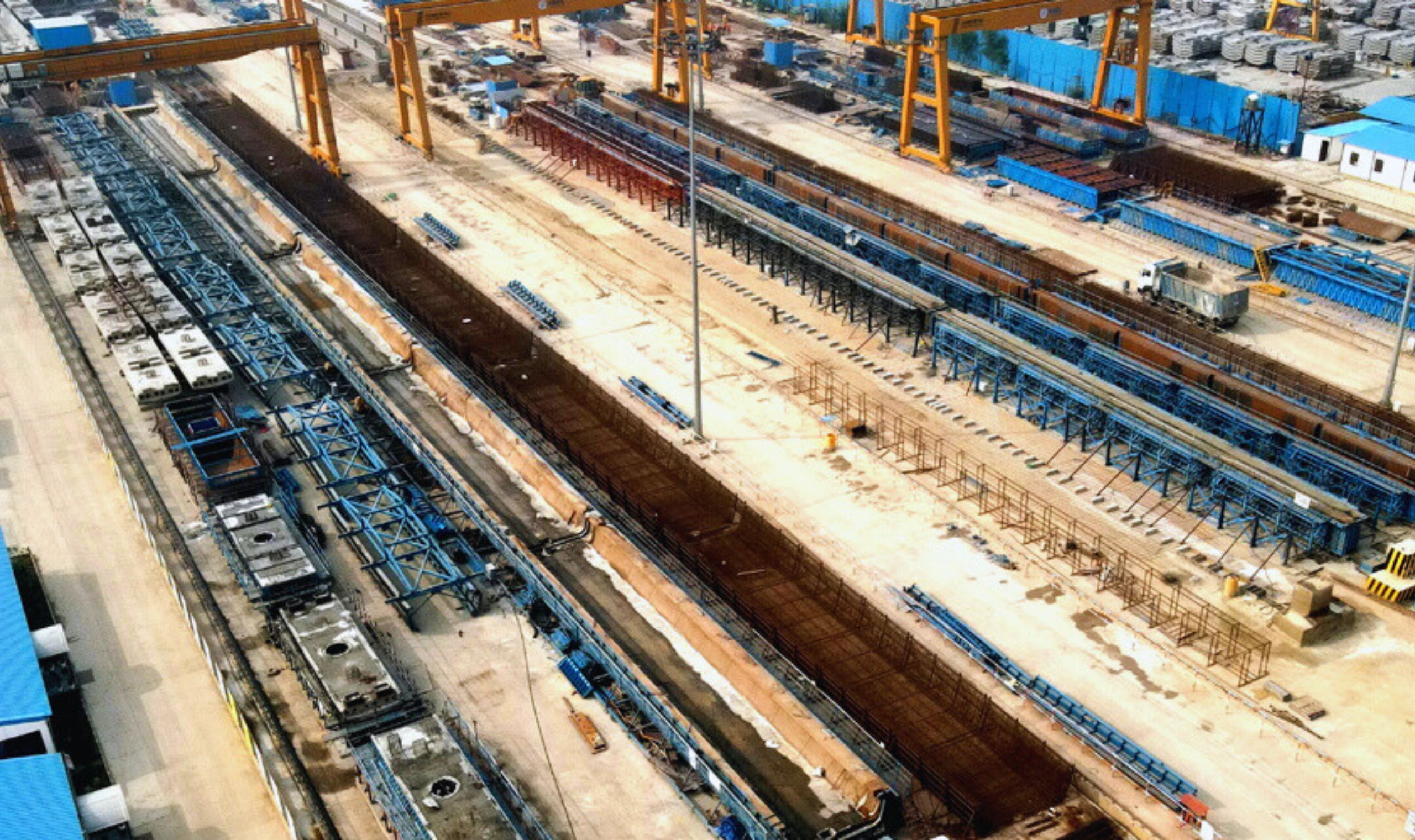

HG Infra has established itself as a strong highway builder of highways, bridges, roads, and civil projects. The group has further diversified into land development and water pipeline projects, mainly in the form of government contracts, which are relatively stable and predictable sources of revenue. HG Infra is headquartered in Rajasthan and is well placed for forthcoming projects, though it is based on experience in infrastructure that faces immense competitive and financial pressures.

-

Operational Efficiency and Long-term Gains

At a level EBITDA margin of 24.3%, up from 23% sequentially last year, this company is striving hard to maintain its operational efficiency despite falling revenues. Long-term growth in this sector will be very helpful to HG Infra since it is expected that India will continue developing infrastructures.

Though Q2 results have some drags, they equally present the steadiness of EBITDA margin by the company, which indeed is a crucial factor and speaks to management controls of costs with significant efficiency, which in the long run, may be very positive for the company.

6 Risks and Challenges Ahead for HG Infra Engineering

Infrastructure will remain strong in its long-term potential, but there are risks before HG Infra that may affect future performance as follows:

1. Constant pressure on profit booking

This has led to the HG Infra share witnessing profit booking recently when the stock slipped 26% over the past three months. Investors may continue taking profits if the company’s quarterly performance does not show improvement in net income or revenue growth.

2. Heavy Dependence on Government Contracts

Government orders constitute a significant share of HG Infra’s business, which often suffers from inevitable delays, regulatory changes, and unfavourable funding. Direct hits on government spending on infrastructures may reduce the revenues and growth prospects of HG Infra in real-time.

3. Economic and Policy Uncertainty

The Infrastructure sector is sensitive to broader macroeconomic and policy shifts. Inflationary pressures, changes in government policy, and surprise changes in project timelines pose problems to the operations and profitability of HG Infra.

4. Competition and Pricing Pressures

Due to high competition in the infrastructure space, HG Infra might see further pricing pressure and might not be able to secure contracts at the going rate. Also, it might face lower profit margins due to low-priced tenders from the projects, such as that recently won in Gujarat.

5. Cash Flow and Financial Management

Infrastructure development projects require significant capital expenditure upfront; delayed payment or high-interest obligations may strain the cash flow of HG Infra. Financial management would thus play a greater role in managing operations in profitability.

6. Analyst Take and Investor Sentiment

Analysts are likely to tread cautiously after Q2 results released by HG Infra, which reported a decline in revenue and a fall in net profit. The decline in recent stock performance will also leave investors a subdued lot. Recent wins such as the Gujarat highway upgrade indicate that the company is not yet competitive enough to secure large contracts.

Long-term investors in HG Infra may be looking for value, hoping to see a positive variation in cash flows and margin maintenance by closely managing the portfolio of projects. They are likely to view current performance and investment somewhere else until clearly sighted turnaround in performance metrics.

Conclusion:

Declining revenues and net profit margins have thus emerged as the key challenges that the Q2 performance of HG Infra Engineering has thrown open. Though the company’s attempts at improvement in efficiency, very well highlighted by stable EBITDA margin, are to be appreciated, the general fall in earnings and revenue has made investors nervous. The latest fall in the company’s stock in the last few months may keep short-term investors, looking for easy returns, away from the present performance.

However, strategic efforts such as winning major government projects under the hybrid annuity model place it well in the competitive landscape of India’s infrastructure sector. Infrastructural spending improvement as an essential pillar for economic development in India provides renewed focus on roadways, highways, and civil construction and new opportunities for HG Infra.

HG Infra is an attractive long-term investment opportunity because of its belief in the ability to successfully ride short-term blips and maintain operational efficiencies. In due course, through good financial management and strategic choices for projects, it will be able to create value for shareholders as it continues its growth journey into traditional and emerging areas of infrastructure space.

Overall, the near-term outlook for HG Infra Engineering will be uncertain under the current pressure on its financials, though the company’s position among leading infrastructure players in India is promising. Investors would do well to watch closely for growth in its revenues, profitability, and how well the company addresses the competitive and operational challenges ahead.

0 Comments