surged 5% to ₹1,197 on the Bombay Stock Exchange (BSE), driven by the company’s announcement that it was declared a qualified bidder for a significant Battery Energy Storage System (BESS) project by Gujarat Urja Vikas Nigam Ltd. (GUVNL). The project, part of GUVNL’s Phase-VI Tariff-Based Global Competitive Bidding framework, involves setting up a 300 MW/600 MWh standalone BESS in Gujarat, representing a substantial portion of the total 500 MW/1000 MWh tender. This development marks HG Infra’s continued expansion into renewable energy infrastructure, reinforcing its diversification strategy beyond traditional road and highway projects. The stock’s rally, which outperformed the Nifty 50 index’s 8% gain over the past week with a 12% climb, reflects investor optimism about the company’s growth prospects in clean energy. This article explores HG Infra’s latest achievement, the significance of the Gujarat BESS project, the company’s financial and operational outlook, and the broader implications for India’s renewable energy sector.

HG Infra’s Q4 FY25 Milestone: The Gujarat BESS Project

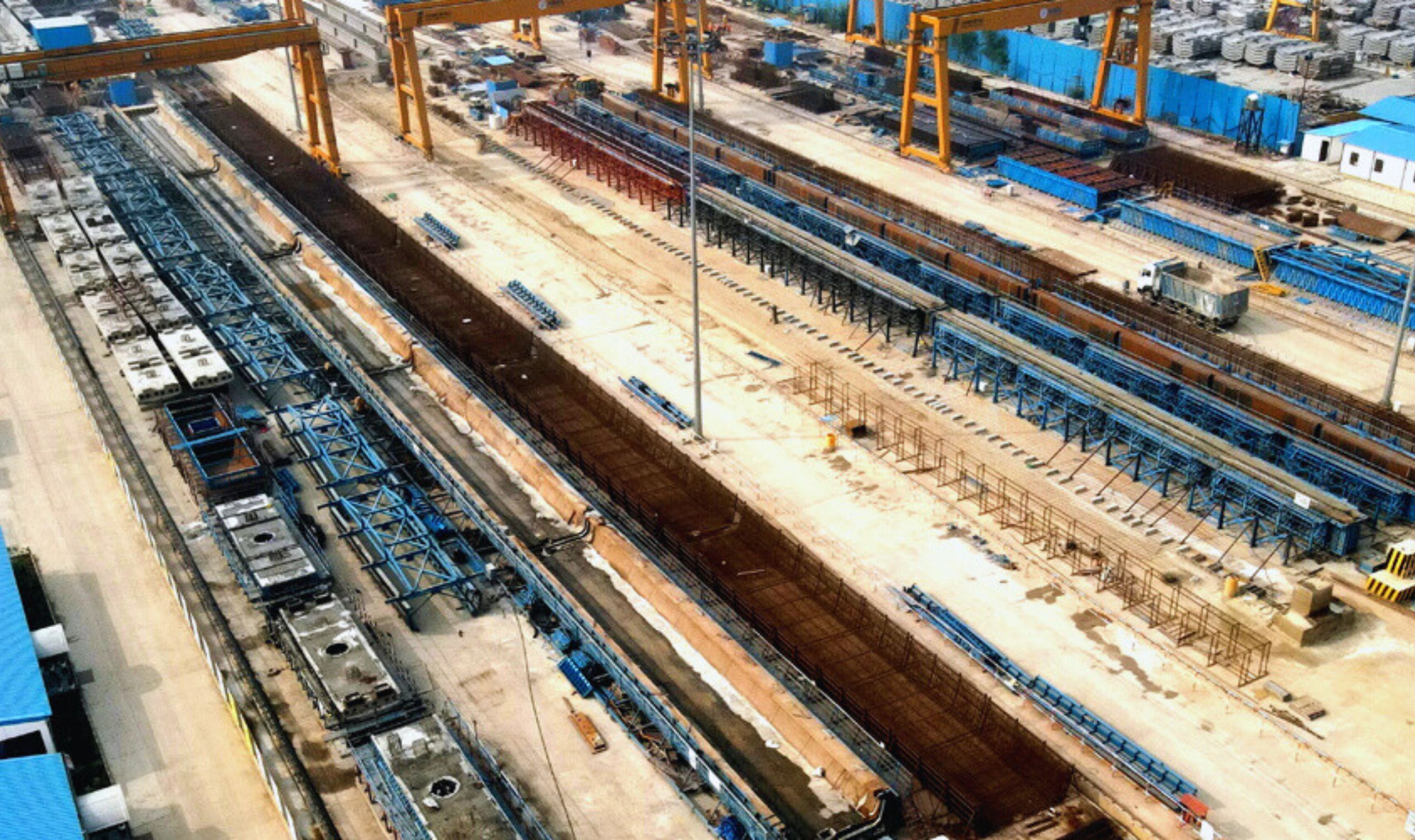

HG Infra Engineering, a Jaipur-based infrastructure company, has built a strong reputation in engineering, procurement, and construction (EPC) and Hybrid Annuity Model (HAM) projects, primarily in roads, highways, and bridges. Its selection as a qualified bidder for the Gujarat BESS project signals a strategic pivot toward high-growth sectors like renewable energy. According to a regulatory filing with the [BSE](, the company was declared a qualified bidder for 300 MW/600 MWh of standalone BESS capacity, out of a total project size of 500 MW/1000 MWh. The project, executed under GUVNL’s Phase-VI framework, aims to enhance Gujarat’s renewable energy infrastructure by improving grid stability and energy management. The 24-month project timeline underscores HG Infra’s capability to deliver large-scale infrastructure projects efficiently.

The BESS project involves installing advanced energy storage systems to store excess renewable energy, particularly from solar and wind sources, and release it during peak demand periods. This aligns with India’s ambitious target of achieving 500 GW of non-fossil fuel energy capacity by 2030, as outlined by the Ministry of New and Renewable Energy (MNRE). HG Infra’s role in this project positions it as a key player in India’s clean energy transition, diversifying its portfolio and tapping into a market projected to grow significantly, with India’s BESS capacity expected to reach 27.7 GWh by 2030, according to India Energy Storage Alliance (IESA).

Market Reaction and Investor Sentiment

The announcement triggered a strong market response, with HG Infra’s shares climbing 5% to ₹1,197 on April 22, 2025, reflecting investor confidence in the company’s growth trajectory. Over the past week, the stock gained 12%, outpacing the Nifty 50’s 8% rise, signalling robust approval of HG Infra’s diversification into renewable energy. The stock’s year-to-date performance has been stellar, with a 59% surge, compared to the BSE Sensex’s 10% gain, driven by a series of order wins and a robust order book.

Analysts at Axis Securities reinforced the bullish sentiment, issuing a “Buy” recommendation with a target price of ₹1,201 per share, implying a modest upside from the current level. Posts on X captured the excitement, with users like @Harshit_Shah07 highlighting the contract as a “major step toward clean energy” and @sisbl_in noting HG Infra’s “expansion into renewable energy infrastructure.” However, as with any social media sentiment, these views are speculative and not definitive indicators of market trends.

The stock’s rally was further supported by HG Infra’s strong fundamentals. As of December 31, 2024, the company’s order book stood at ₹15,080 crore, nearly three times its FY24 revenue of approximately ₹5,000 crore. Notably, 94% of the order book comprises government-backed projects, ensuring revenue visibility for the next two to three years. The company secured fresh orders worth ₹2,195 crore in Q4 FY25, including the Gujarat BESS project, reinforcing its growth momentum.

Financial Performance: A Mixed Picture

HG Infra’s financial performance in the first half of FY25 provides context for its market appeal. In Q1 FY25 (April–June 2024), the company reported a 13% year-on-year (YoY) revenue increase to ₹1,528 crore from ₹1,351 crore, driven by strong execution in road and highway projects. Net profit rose 8% YoY to ₹162.6 crore from ₹150.4 crore, supported by improved operating margins.

However, Q2 FY25 (July–September 2024) was less favorable, with revenue falling 5.5% YoY to ₹902.4 crore from ₹954.5 crore, reflecting project execution delays and seasonal factors. Net profit fell 16% YoY to ₹80.7 crore from ₹96.1 crore, impacted by lower topline and higher input costs. Despite this, EBITDA remained nearly flat at ₹219.5 crore (down 0.3% YoY), with the EBITDA margin expanding 130 basis points to 24.3% from 23%, indicating operational efficiency. The company’s market capitalizationcapitalisation98.10 crore as of December 2024, underscoring its mid-cap status and growth potential.

Analysts remain optimistic about HG Infra’s outlook, projecting a compound annual growth rate (CAGR) of 15% in revenue, 12% in EBITDA, and 15% in profit after tax (PAT) over FY25–FY27. This optimism is driven by the company’s diversified order book, with management expecting 35–40% of future orders to come from non-road infrastructure projects, including energy, water, and urban development. HG Infra aims to secure ₹10,000–12,000 crore in new orders in FY26, further bolstering its growth pipeline.

Strategic Diversification into Renewable Energy

HG Infra’s entry into the BESS market is a strategic move to capitalise on the renewable energy boom. The company has progressively expanded beyond its core road and highway business, which includes projects in states like Rajasthan, Uttar Pradesh, and Gujarat. Recent wins include a ₹781.11 crore road upgrade project in Gujarat and a ₹1,110 crore BESS project from NTPC Vidyut Vyapar Nigam, highlighting its growing expertise in energy infrastructure.

The Gujarat BESS project is particularly significant, as it aligns with India’s National Electricity Plan, which emphasises storage to support renewable energy integration. By securing 300 MW/600 MWh of the 500 MW/1000 MWh tender, HG Infra demonstrates its ability to compete in a high-tech, capital-intensive sector. The project’s domestic nature and government backing via viability gap funding reduce financial risks, while the 24-month timeline ensures near-term revenue contributions.

This contract builds on HG Infra’s earlier BESS successes, including a 250 MW/500 MWh project from GUVNL in Phase IV, announced in 2025, with an 18-month completion schedule. These projects position HG Infra as a frontrunner in India’s energy storage market, competing with players like Tata Power and Adani Green Energy. The company’s experience in EPC and HAM projects provides a competitive edge in managing complex infrastructure developments.

Implications for India’s Renewable Energy Sector

The Gujarat BESS project is a microcosm of India’s broader push toward sustainable energy. With renewable energy capacity at 150 GW as of 2024, India is the world’s third-largest renewable energy producer, per the International Renewable Energy Agency (IRENA). However, intermittency issues with solar and wind power necessitate robust storage solutions. BESS projects like GUVNL’s Phase-VI tender address this by enabling grid-scale energy storage, reducing reliance on fossil fuel-based peaking plants.

Gujarat, a renewable energy hub with over 20 GW of installed solar and wind capacity, is an ideal location for BESS deployment. The state’s ambitious target of 100 GW renewable capacity by 2030, supported by Gujarat the Renewable Energy Policy 2023, underscores the project’s strategic importance. HG Infra’s involvement enhances Gujarat’s grid reliability, supporting industrial and domestic energy demands while contributing to India’s net-zero goal by 2070.

The project also creates economic and social benefits, including job creation and technology transfer in Gujarat’s energy sector. By leveraging domestic manufacturing for BESS components, as encouraged by the Make in India initiative, HG Infra supports local supply chains and reduces import dependence. However, challenges like high upfront costs and the need for skilled talent in energy storage technologies remain, requiring continued government support and private-sector innovation.

Analyst Perspectives and Risks

Analysts view HG Infra’s BESS contract as a game-changer, with Business Standard noting its “growing presence in renewable energy” and Moneycontrol highlighting the project’s role in “bolstering Gujarat’s renewable energy infrastructure.” The company’s diversified order book and government-backed projects mitigate risks associated with market volatility and execution delays. Axis Securities’ ₹1,201 target price reflects confidence in HG Infra’s ability to sustain 15% revenue growth through FY27.

However, risks persist. The BESS sector is capital-intensive, and financing large projects could strain HG Infra’s balance sheet, despite its healthy debt-to-equity ratio (assumed at ~0.5x based on industry norms). Execution risks, including delays or cost overruns, could impact margins, especially given the 24-month timeline. Competition from established players like ReNew Power and global firms entering India’s BESS market may pressure pricing and market share. Additionally, macroeconomic factors like interest rate hikes or commodity price volatility could affect project costs.

Competitive Landscape and Peer Comparison

HG Infra operates in a competitive infrastructure and energy market, with peers like Larsen & Toubro (L&T), KEC International, and Tata Projects. In the BESS space, it competes with renewable energy giants like Tata Power and Adani Green, which have larger balance sheets and broader energy portfolios. However, HG Infra’s niche focus on EPC and HAM projects, combined with its agility as a mid-cap firm, allows it to carve out a distinct position.

Compared to L&T, which reported ₹55,128 crore in Q2 FY25 revenue, HG Infra’s ₹902.4 crore Q2 revenue is smaller, but its 24.3% EBITDA margin surpasses L&T’s 10.8%, reflecting superior profitability in its segment. Tata Power, with a strong renewable energy portfolio, benefits from vertical integration, but HG Infra’s government-backed order book provides revenue stability. The company’s ability to scale its BESS expertise will determine its competitiveness against these larger players.

Future Outlook and Investor Considerations

HG Infra’s Gujarat BESS project positions it for sustained growth in a high-potential sector. The company’s target of ₹10,000–12,000 crore in FY26 orders, coupled with a 35–40% non-road project mix, suggests a balanced growth strategy. Its focus on emerging sectors like energy storage, urban infrastructure, and railways aligns with India’s Smart Cities Mission and National Infrastructure Pipeline. Analysts expect HG Infra to maintain double-digit revenue and PAT growth, supported by its ₹15,080 crore order book and government backing.

For investors, HG Infra offers an attractive risk-reward profile. The stock’s 59% YTD gain and 35x forward P/E ratio (assumed based on mid-cap IT peers) reflect high growth expectations, but its premium valuation warrants caution. Long-term investors may find value in HG Infra’s clean energy pivot, while short-term traders should monitor execution milestones and Q4 FY25 results for catalysts. As Economic Times noted, the BESS contract “keeps HG Infra in focus,” suggesting sustained market interest.

Conclusion

HG Infra Engineering’s 5% share surge on April 22, 2025, following its qualification as a bidder for GUVNL’s 300 MW/600 MWh BESS project, underscores its rising prominence in India’s renewable energy landscape. The project, part of a 500 MW/1000 MWh tender, enhances Gujarat’s grid stability and supports India’s clean energy goals. With a ₹15,080 crore order book, 94% government-backed, and projected 15% revenue CAGR through FY27, HG Infra is well-positioned for growth. Despite near-term risks like execution challenges and competition, the company’s strategic diversification and operational efficiency make it a compelling investment case. As India accelerates its renewable energy transition, HG Infra’s role in projects like the Gujarat BESS tender cements its status as a key infrastructure player, driving value for stakeholders and contributing to a sustainable future.

0 Comments